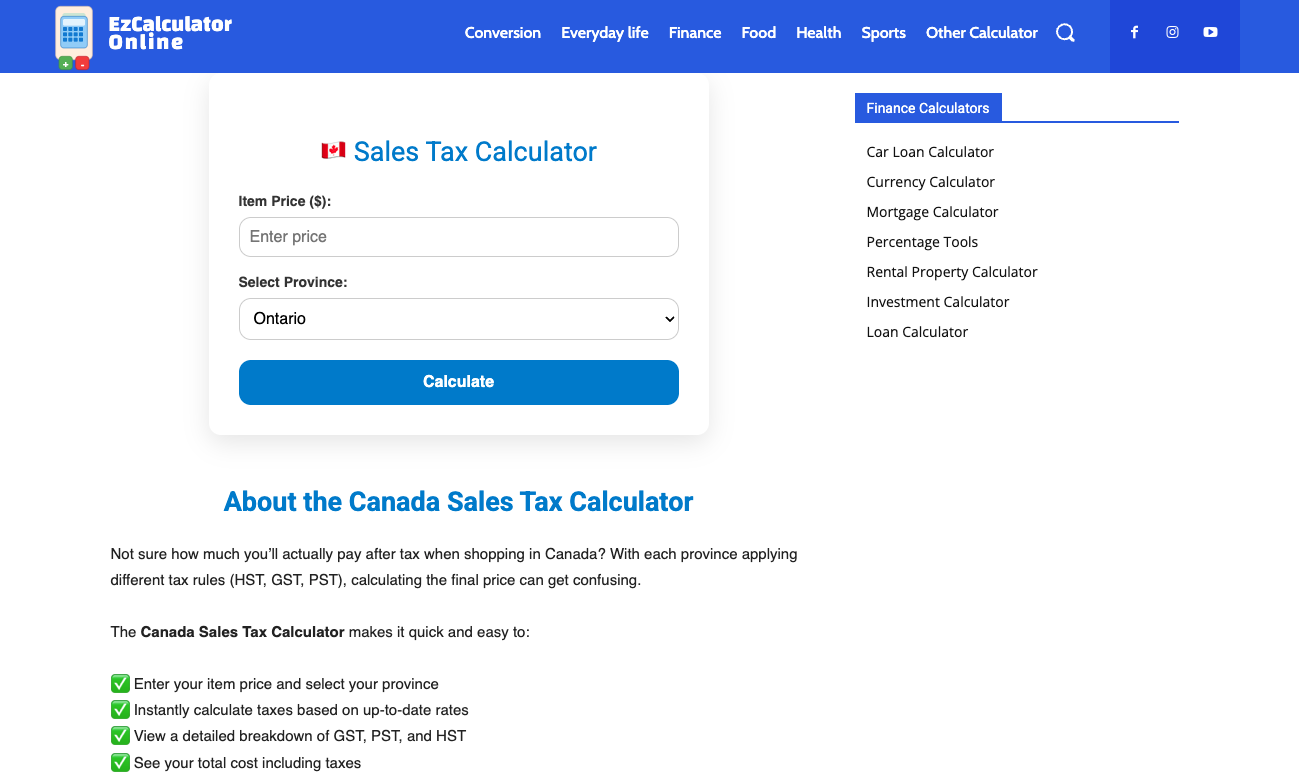

About the Canada Sales Tax Calculator

Not sure how much you’ll actually pay after tax when shopping in Canada? With each province applying different tax rules (HST, GST, PST), calculating the final price can get confusing.

The Canada Sales Tax Calculator makes it quick and easy to:

✅ Enter your item price and select your province

✅ Instantly calculate taxes based on up-to-date rates

✅ View a detailed breakdown of GST, PST, and HST

✅ See your total cost including taxes

⚙️ Who is this tool for?

-

Online shoppers across Canada

-

Small businesses or sellers setting post-tax prices

-

Newcomers looking to understand provincial tax systems

-

Anyone who wants fast, accurate sales tax estimates

📌 Covers all Canadian provinces and territories:

Ontario, Quebec, British Columbia, Alberta, Manitoba, Saskatchewan, Nova Scotia, New Brunswick, Newfoundland and Labrador, Prince Edward Island, Yukon, Northwest Territories, and Nunavut.

Just enter your price and pick a province to get started 👉

There are three types of sales taxes in Canada: PST, GST and HST. See below for an overview of sales tax amounts for each province and territory.

| Province | Type | PST | GST | HST | Total Tax Rate | Notes: |

|---|---|---|---|---|---|---|

| Alberta | GST | 5% | 5% | |||

| British Columbia | GST + PST | 7% | 5% | |||

| Manitoba | GST + PST | 7% | 5% | 12% | As of July 1, 2019 the PST rate was reduced from 8% to 7%. | |

| New Brunswick | HST | 15% | 15% | As of July 1, 2016 the HST rate increased from 13% to 15%. | ||

| Newfoundland and Labrador | HST | 15% | 15% | As of July 1, 2016 the HST rate increased from 13% to 15%. | ||

| Northwest Territories | GST | 5% | 5% | |||

| Nova Scotia | HST | 14% | 14% | |||

| Nunavut | GST | 5% | 5% | |||

| Ontario | HST | 13% | 13% | |||

| Prince Edward Island | HST | 15% | 15% | |||

| Quebec | GST + *QST | 9.975% | 5% | 14.975% | ||

| Saskatchewan | GST + PST | 6% | 5% | 11% | ||

| Yukon | GST | 5% | 5% |