🇨🇦 Canada Income Tax Calculator 2025 – Estimate Your Refund or Amount Owed

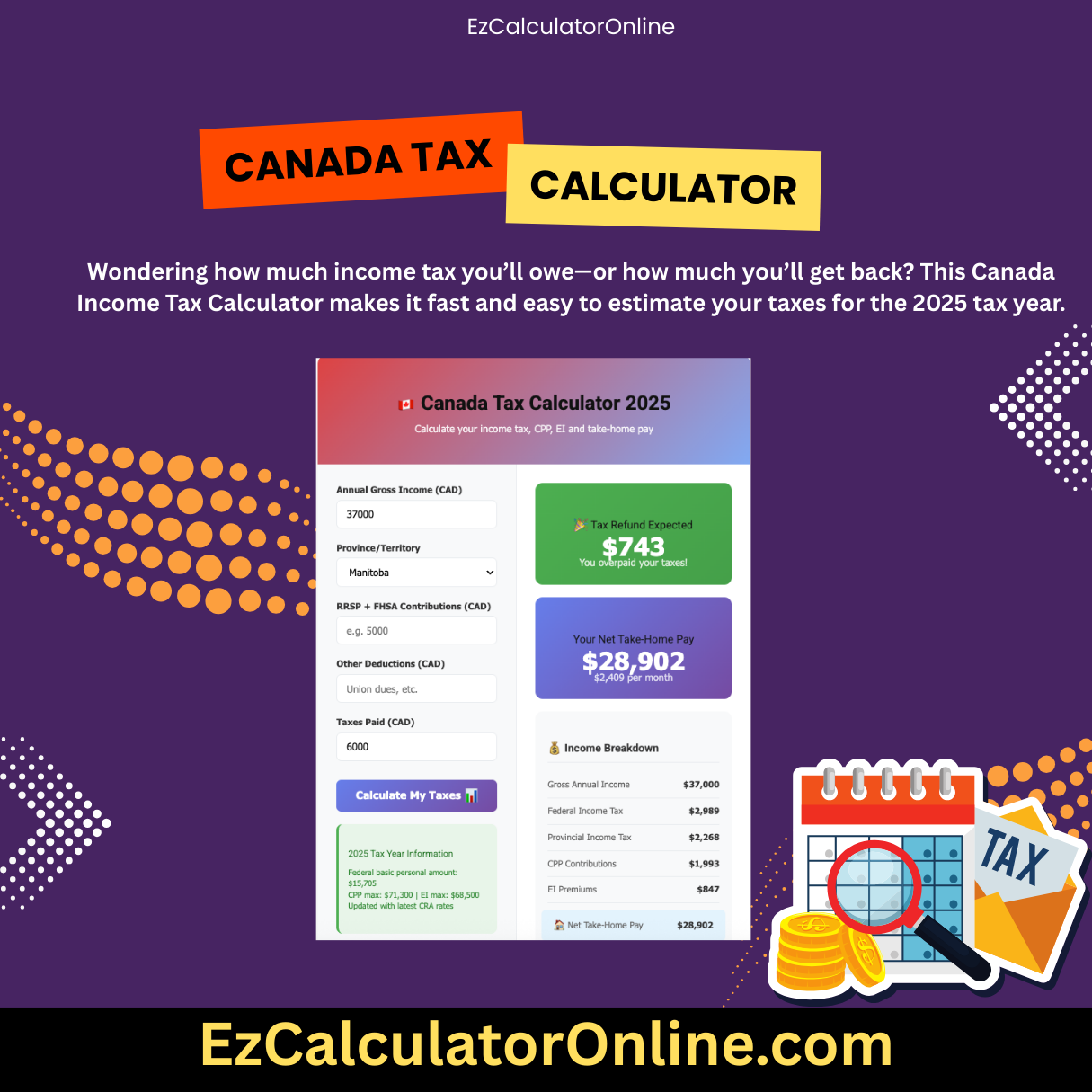

Wondering how much income tax you’ll owe—or how much you’ll get back? This Canada Income Tax Calculator makes it fast and easy to estimate your taxes for the 2025 tax year. Whether you’re an employee, self-employed, or have other sources of income, this tool helps you get a clearer picture of your tax situation.

Simply enter your income, province or territory, and relevant deductions like RRSP contributions, FHSA, charitable donations, CPP, and EI premiums. You can also include taxes you’ve already paid to see whether you’ll receive a refund or need to pay additional taxes.

✅ Why Use This Tax Calculator?

-

✔️ Updated with 2025 federal and provincial tax brackets

-

✔️ Supports all Canadian provinces and territories

-

✔️ Includes common deductions and credits (e.g. RRSP, FHSA, donations, CPP, EI)

-

✔️ Clearly shows if you owe tax or will receive a refund

-

✔️ Mobile-friendly and easy to use—get results in under a minute

-

✔️ Great for personal planning or preparing before you file your tax return

Whether you live in Ontario, Quebec, Alberta, British Columbia, or anywhere else in Canada, this calculator breaks down your estimated tax results based on the latest income tax rules.

🔍 Note: This tool provides a quick estimate only. It does not include every available credit or deduction. For exact results, consult a tax expert or use official CRA-approved tax filing software.